Sail Away With Saint Lucia Citizenship By Investment

The Saint Lucia Citizenship By Investment program has become a popular choice for investors looking for second citizenship. The program is one of the world’s most affordable and offers access to an economically and politically stable country – the perfect insurance policy for investors worldwide.

Saint Lucia is a sovereign island nation in the Eastern Caribbean Sea known for being one of the most beautiful Caribbean islands.

About Saint Lucia

Saint Lucia is a captivating island of the Lesser Antilles belonging to the Commonwealth, located in the Eastern Caribbean Sea. Saint Lucia is known for its tropical climate and unique natural scenery with breathtaking mountain panoramas and lush rainforests.

As a member of the Commonwealth and CARICOM, Saint Lucia boasts excellent air links to Europe and North America. Its natural beauty, coupled with its unique blend of British and French influences, gives Saint Lucia a distinctive charm that visitors and investors find alluring.

CAPITAL

Castries

POPULATION

183,591

TOTAL AREA

617 km²

CURRENCY

East Caribbean Dollar

Geographical Location and Climate

Nestled northwest of Barbados and south of Martinique, Saint Lucia lies within the Windward group in the Lesser Antilles. The island stretches 27 miles long and has a maximum width of 14 miles. With predominantly volcanic origins, the landscape is characterized by a range of wooded mountains running north to south, the highest peak being Mount Gimie at 3,145 feet. The climate in Saint Lucia is classified as tropical maritime and benefits from northeast trade winds. Temperature and rainfall vary according to elevation, with average annual precipitation ranging from 51 inches along the coast to as much as 150 inches inland. A dry season typically occurs from January to April, while the rainy season runs from May to November. The mean temperature hovers around 80°F, with occasional highs in the upper 80s and lows in the upper 60s.

Language and Culture

Since gaining independence in 1979, Saint Lucia has cultivated a harmonious blend of British and French cultural influences, which is reflected in its vibrant customs and traditions. English serves as the official language, allowing for seamless communication in business and travel. However, the local population often speaks Saint Lucian Creole, a French-based Creole language that showcases the island’s rich history and connection with France. Saint Lucia’s culture also shines through its colorful festivals, such as the Saint Lucia Jazz & Arts Festival and the annual Carnival, which showcase the island’s lively music, dance, art, and cuisine. The island’s rich heritage is further demonstrated through its architecture, with some of the best examples being old plantation houses and charming fishing villages.

Economic Overview

Saint Lucia’s economy has long been supported by a robust legal and commercial infrastructure, a tradition of private-sector entrepreneurial dynamism, and a well-educated workforce. Over the years, the country has developed an efficient and transparent business environment with a more streamlined regulatory framework. However, access to financing opportunities could be improved to encourage even more private-sector development. Major contributors to the island’s economy include tourism, banana production, and light manufacturing industries. In recent years, substantial foreign investment has been attracted by Saint Lucia’s public infrastructure improvements, along with an emphasis on diversifying from bananas to other commodities. The government has identified growth potential in communications and information technology as a priority for future development.

Why Choose The Saint Lucia Citizenship By Investment Program

FAST ACCESS TO A STRONG PASSPORT

Obtain your Saint Lucian passport and citizenship in just 4 months. Your permanent residency card can be issued without the need to visit or reside on the island.

FAVORABLE TAX ENVIRONMENT

Tax incentives are another major attraction as St. Lucia has a relatively low taxation system, including exemptions from paying tax on capital gains, inheritances, global income, and withholding tax for resident companies. This is beneficial for investors, especially those seeking business development opportunities within the country.

VISA-FREE TRAVEL

As a Saint Lucian citizen, you will benefit from visa-free travel to over 150 countries, including all Schengen states, the United Kingdom, and most British Commonwealth member countries. Obtaining most foreign visas will also be quick and easy.

FAMILY SAFETY AND SECURITY

There are no residence or visitation requirements associated with the Saint Lucia Citizenship by Investment Program. Furthermore, applicants can include spouses, dependent children under 31, siblings under 18, and parents aged 55 and over in their application. The program also has attractive investment and processing costs, making it highly appealing for affluent individuals. The program also has a low minimum investment amount of only USD 100,000.

How to Qualify

for the Saint Lucia Citizenship by Investment Program

The Saint Lucia Citizenship by Investment Program presents a remarkable chance for individuals and families to obtain a second passport, granting them the privilege of visa-free entry to a host of global locations. Continue reading to discover everything essential for eligibility in this prestigios economic citizenship scheme, encompassing criteria, avenues for investment, and details on tax obligations.

To qualify for the Saint Lucia Citizenship By Investment program, applicants must:

- Be in good health (and provide proof with a medical certificate).

- Be 18 years or older.

- Must not be the subject of a current criminal investigation unless it is a minor offense.

- Have a clean criminal record.

- Not be deemed a security risk.

- Must not have restrictions or bans on entering the UK, the USA, the European Union, or Canada.

Saint Lucia Citizenship By Investment Options

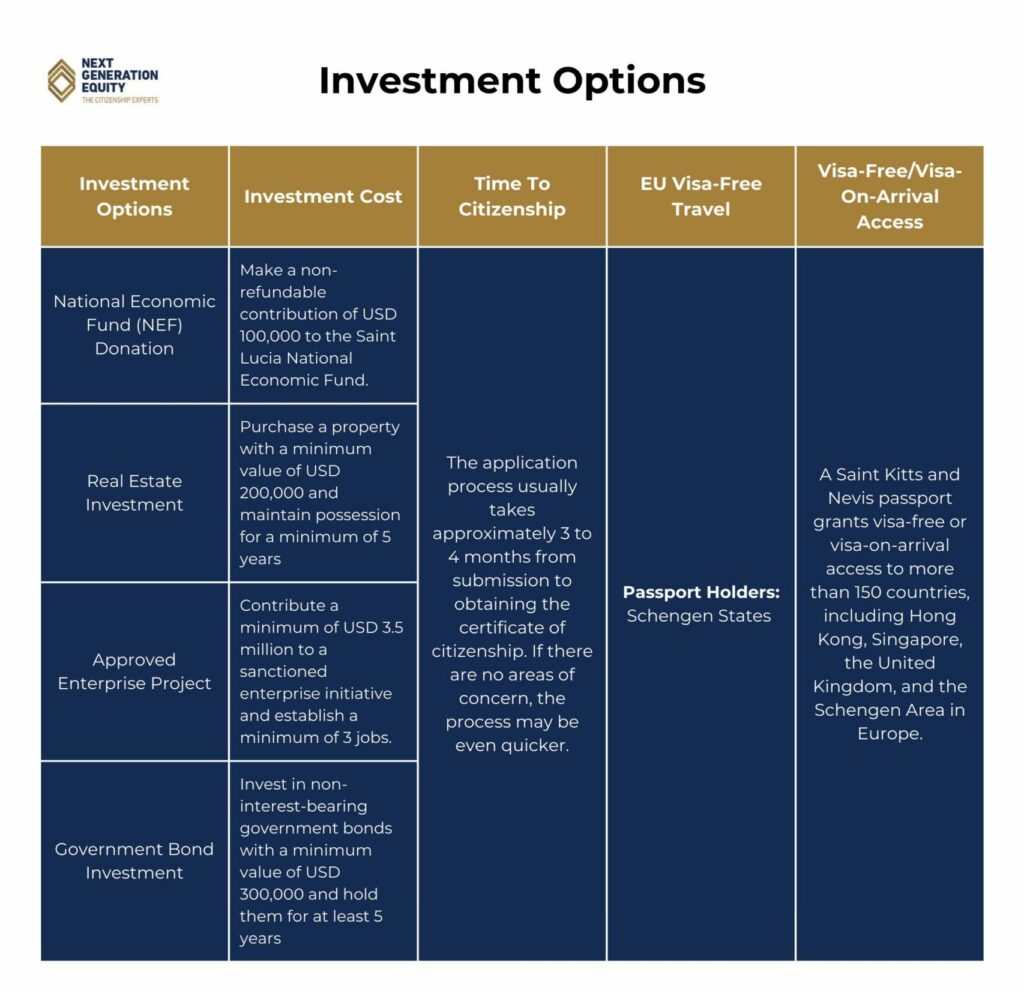

Saint Lucia offers several investment options to obtain citizenship, including real estate purchase, contribution to the National Economic Fund, approved enterprise projects, and government bond purchase. Minimum investments range from $100,000 for a single applicant to $6 million for joint enterprise projects. Applicants must hold investments for 5 years and have no criminal records.

1. Real Estate Investment

Applicants must purchase a property with a minimum value of USD 200,000 from an authorized development venture and maintain possession for a minimum of 5 years.

Additional Fees (Real Estate Option)

| Main Applicant | Spouse | Children under 16 years of age | Children over 16 years of age | |

|---|---|---|---|---|

| State Fee | USD 30,000 | USD 15,000 | USD 5,000 (or USD 10,000 if you have more than 4 dependants) | USD 10,000 |

| Application Processing Fee | USD 2,000 | USD 1,000 | USD 1,000 | USD 1,000 |

| Due Diligence Fee | USD 8,000 | USD 5,000 | Nil | USD 5,000 |

| Passport Fee | USD 500 | USD 500 | USD 500 | USD 500 |

2. National Economic Fund (NEF) Donation

Make a non-refundable contribution of USD 100,000 to the Saint Lucia National Economic Fund.

The amounts required are as follows:

– USD$100,000 for a single applicant

– USD$140,000 for a main applicant and spouse

– USD$150,000 for a main applicant, spouse, and up to two qualifying dependents

– USD$15,000 for each additional dependent applying with the main applicant, spouse, and other qualifying dependents

– USD$25,000 for each qualifying dependent

Additional Fees (NEF Option)

| Main Applicant | Spouse | Children under 16 years of age | Children over 16 years of age | |

|---|---|---|---|---|

| State Fee | USD 4,130 | USD 5,760 | 2 extra children of any age=USD 8,020 | 3 extra children of any age= USD 10,650 |

| Application Processing Fee | USD 2,000 | USD 1,000 | USD 1,000 | USD 1,000 |

| Due Diligence Fee | USD 8,000 | USD 5,000 | Nil | USD 5,000 |

| Passport Fee | USD 500 | USD 500 | USD 500 | USD 500 |

3. Approved Enterprise Project

Applicants must contribute a minimum of USD 3.5 million to a sanctioned enterprise initiative and establish a minimum of three long-term employment positions. As an alternative, applicants can contribute jointly a total of USD 6 million (with each investing at least USD 1 million) and generate no less than six permanent job opportunities.

Additional Fees (Enterprise Project Option)

| Main Applicant | Spouse | Children under 18 years of age | Children over 18 years of age | |

|---|---|---|---|---|

| Administrative Fee | USD 50,000 if applying as a solo investor or USD 75,000 if applying as a joint enterprise | USD 35,000 | USD 25,000 | USD 35,000 |

| Application Processing Fee | USD 2,000 | USD 1,000 | USD 1,000 | USD 1,000 |

| Due Diligence Fee | USD 8,000 | USD 5,000 | Nil | USD 5,000 |

| Passport Fee | USD 500 | USD 500 | USD 500 | USD 500 |

4. Government Bond Investment

Invest in non-interest-bearing government bonds with a minimum value of USD 300,000 and hold them for at least 5 years. All qualifying dependents must also have clean personal backgrounds with no criminal records and should not be under any criminal investigation.

Additional Fees (Government Bond Option)

| Main Applicant | Spouse | Children under 16 years of age | Children over 16 years of age | |

|---|---|---|---|---|

| Administrative Fee | USD 50,000 | Nil | Nil | Nil |

| State Fee | USD 4,130 | USD 5,760 | 2 extra children of any age=USD 8,020 | 3 extra children of any age= USD 10,650 |

| Application Processing Fee | USD 2,000 | USD 1,000 | USD 1,000 | USD 1,000 |

| Due Diligence Fee | USD 8,000 | USD 5,000 | Nil | USD 5,000 |

| Passport Fee | USD 500 | USD 500 | USD 500 | USD 500 |

Saint Lucia CBI Application Process

Register with NGE

Sign a retainer agreement with Next Generation Equity so we can help with your application process. We are a trusted, government-approved facilitator of Citizenship by Investment programs.

Gather Documents

Work with Next Generation Equity to gather all essential documents. We will ensure that everything is properly arranged.

Submission

Once your documents are ready, we will forward your application to the Saint Lucia Citizenship by Investment Unit (CIU). We will manage all further communications regarding your application.

Interview Process

Each applicant (16 years or above) must attend an interview virtually, in person at Saint Lucia, or at another location approved by the Board of Governors of the CIU.

Review

The CIU will review your application and perform due diligence checks on all applicants. If deemed acceptable, the CIU will send a letter of approval within 60-90 days of receiving the application with the status ‘approval in principle’.

Final Steps

If approved, you will receive instructions to make the required contribution or to finalize your property purchase within 90 days. You will need to send proof of this to the CIU. Additionally, you will need to sign an oath or affirmation of allegiance before a notary public, attorney-at-law, or notary royal. Once the payment is confirmed you will receive your certificate of naturalisation and passport/s within 4 weeks.

Saint Lucia CBI Processing Times

The application process usually takes approximately 3 to 4 months from submission to obtaining the certificate of citizenship. If there are no areas of concern, the process may be even quicker. However, if delays are expected in exceptional cases, applicants will be informed of the reason behind the delay.

Benefits Of Saint Lucia Citizenship By Investment Program

Inclusion of Family Members

Applicants can include their spouses and extra dependents in their applications for additional fees. This way, the entire family can relocate and enjoy the privileges of this second passport.

Favorable Tax Environment

As a Saint Lucian tax resident, you avoid paying any tax on capital gains, inheritances and dividends. Additionally, residents pay tax on royalties and interest at 10% as opposed to non-residents who pay 15-25%.

No Minimum Residency Requirements

Unlike other Citizenship by Investment programs, Saint Lucia does not require successful applicants to stay in the country. Whilst they have the opportunity to visit or live in Saint Lucia, they can reside in their home country whilst reaping the benefits of their new citizenship.

Extensive Travel Rights

A Saint Kitts and Nevis passport grants visa-free or visa-on-arrival access to more than 150 countries, including Hong Kong, Singapore, the United Kingdom, and the Schengen Area in Europe. This benefit of unrestricted mobility allows investors and their families to enjoy hassle-free international travel for both business and leisure purposes.

Dual Citizenship

Saint Lucia allows dual citizenship, which enables investors to keep their original nationality without any legal issues or potential conflicts with their home country.

Lifelong Citizenship

The citizenship granted through the investment program is not only valid for life but can also be passed down to future generations by descent. This ensures a legacy of security and prosperity for your family in the years to come.

Easy to Access

As a member of the Commonwealth and CARICOM, the country enjoys strong air links with Europe and North America.

Access to Long-Stay Visas

Citizens of Saint Lucia have the option to enjoy long stays in many countries, including America, Europe, and Canada. Citizens who want to visit the US can apply for a 10-year multiple entry access B1 Tourist Visa and B2 Business Visa at any US consulate.

Desirable Lifestyle

With its lush rainforests and pristine beaches, Saint Lucia is a great location for owning a second home. The island is famous for its magical beaches, and striking twin peaks which are known as the Pitons. Residents can enjoy the vibrant culture in Saint Lucia, with its African, French, and British influences.

Taxes in Saint Lucia

Saint Lucia offers a relatively straightforward taxation system for individuals and companies alike. To become a tax resident in Saint

Lucia, you must reside in the country for at least 183 days per year. We will outline the key aspects of taxation in Saint Lucia for potential expats to understand before making their move.

Individual Taxation

Expats residing in Saint Lucia are subject to income tax based on their residency status. Individuals who are resident or ordinarily resident in the country are taxed on all income accrued from sources both within and outside Saint Lucia. However, if you are a resident but not ordinarily resident, income earned within Saint Lucia and any remitted income from abroad will be subject to taxation.

For non-residents, income earned within Saint Lucia and received in the country from foreign sources is subject to income tax. It is important to note that, unlike the U.S., St. Lucia does not impose worldwide personal income tax on international non-residents. The income tax rate in Saint Lucia is calculated using a scaled bracket system, with rates increasing as the value of income increases. The minimum taxable personal income starts at $25,400 East Caribbean Dollars (XCD).

- Income up to $15,000 XCD is taxed at 15%

- Income between $15,001 to $30,000 XCD is taxed at 20%

- Income over $30,000 XCD is taxed at 30%

All individual residents must file their annual taxes through the Inland Revenue Department’s website or in person.

Value-Added Tax (VAT) in Saint Lucia

The VAT system in Saint Lucia is relatively simple, with a flat rate of 12.5% levied on most goods and services. There are, however, some exceptions and reduced rates granted to certain businesses or industries. For instance, the hotel sector and related service providers benefit from a reduced 7% VAT rate, as introduced in December 2020.

Certain goods and services, such as residential rental, education services, finance services, insurance services, medical services, local transportation, and essential items like chicken, milk, or bread, are exempt from VAT.

Companies are VAT-exempt from sales up to XCD $400,000.

As of July 31st, 2023, the government has implemented a 2-year VAT amnesty on selected imports and tax penalties. There will be a VAT amnesty of medical equipment, building materials, and arrears. This offers business owners, companies, employees, and property owners the chance to settle their tax arrears with a 100% waiver on interest, penalties, and collection fees up to the financial year 2021.

Additionally, employees earning XCD $2116 monthly will not be subjected to Pay-As-You-Earn (PAYE) tax.

Property Tax in Saint Lucia

Property owners in Saint Lucia must pay property taxes annually. The tax levied on residential properties is a modest 0.25% of their fair market value, while commercial properties are taxed at a slightly higher rate, 0.4%.

Stamp Duty in Saint Lucia

A stamp tax is charged on legal or contractual documents. Rates for this tax vary depending on the instrument being used. Companies filing legal documentation with authorities must usually pay between 2% and 10% of the instrument’s value as stamp tax. In summary, Saint Lucia offers expats an attractive tax regime that balances simplicity and competitiveness.

With no capital gains, inheritance, or wealth taxes, it has become an appealing destination for individuals and businesses seeking favorable tax conditions coupled with a high-quality lifestyle in the picturesque setting of the Caribbean. Stay informed about the local tax requirements, and consult a professional tax advisor if necessary to ensure smooth financial integration into life in Saint Lucia.

Corporate Tax

Corporate tax is payable on all income received by a corporation from sources both inside and outside of Saint Lucia. The submission of the income tax returns is 3 years after the end of the financial year.

The residency of a company is determined by the country where the company is managed and controlled. Profits earned directly or indirectly by a non-resident company operating through a permanent establishment in Saint Kucia are taxed at a corporate rate of 33.3%. When a non-resident company earns income from sources other than operating through a permanent establishment in Saint Lucia, the total amount of that income is subject to a 25% withholding tax.

Saint Lucia Citizenship by Investment FAQs

Does Saint Lucia Allow Dual Citizenship?

Yes, Saint Lucia allows dual citizenship. There are no restrictions on dual citizenship in the country.

How Much Does It Cost To Buy Citizenship In Saint Lucia?

The cost to obtain citizenship through investment in Saint Lucia varies depending on the chosen route. The lowest cost is via a non-refundable donation to the National Economic Fund, with a minimum contribution of USD 100,000 for a single applicant. Other routes include investing in government-approved real estate projects from USD 200,000 and investing in non-interest-bearing government bonds with a minimum value of USD 300,000. Additional fees apply.

Can A Foreigner Start A Business In Saint Lucia?

Foreigners can start a business in Saint Lucia, but they will be subject to local laws, regulations, and taxation policies. Companies are taxed at a flat rate of 33.3% on income generated within Saint Lucia.

What Is The Business Tax Rate In Saint Lucia?

The business tax rate in Saint Lucia is 33.3% for corporate income tax. This rate applies to all types of income from any sources within the country, and resident companies must file their taxes on an annual basis.

Which Caribbean Passport Is The Best?

As of 2023, Barbados holds the best Caribbean passport, offering visa-free access to 163 destinations. Rankings can change over time, so it’s essential to keep up to date with the latest information.

Which countries does Saint Lucia have tax and investment treaties with?

Saint Lucia has signed tax agreements with the Caribbean Community (CARICOM). There is no signed taxation treaty with the USA, however there is a bilateral Tax Information Agreement. It also has bilateral investment treaties with the UK, Germany, and CARICOM.